Shelford Wealth Strategies: Reasonable Compensation Reports For Small Business Owners

At Shelford Wealth Strategies, we empower small business owners, influencers, and content creators with the tools and expertise needed to reduce taxes, optimize profits, and ensure IRS compliance for S-Corp owners with our Reasonable Compensation Reports.

WHAT WE DO

Shelford Wealth Strategies: Unlock Hidden Profits and Achieve Financial Peace of Mind

We specialize in providing IRS-safe Reasonable Compensation Reports and strategic tax insights designed to maximize your profits and secure your financial future. With our proven systems and expert guidance, you’ll gain the confidence to make informed decisions that protect and grow your wealth.

Services

Shelford Wealth Strategies Solutions For Your Small Business

Reasonable Compensation Reports

Ensure your S-Corp is compliant with the IRS by determining the right salary for yourself. Our detailed reports are designed to withstand IRS scrutiny while maximizing your tax savings.

Reduce Your Taxes

Discover how to legally reduce your tax burden with our innovative tax strategies. We’ll guide you through our innovative tax reducing strategies that are used by the wealthy.

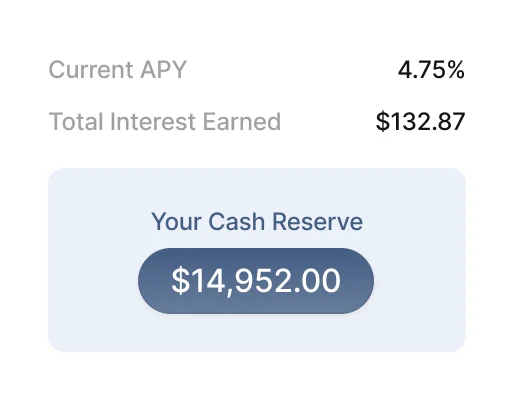

Grow Investments Tax-Free

Grow your nest egg tax-free by leveraging multiple ‘tax-smart‘ investment accounts. These are the exact tools the wealthy use to protect and grow their wealth.

Mission

Why Choose Shelford Wealth Strategies?

Shelford Wealth Strategies offers trusted financial strategies tailored to small business owners, influencers, and content creators, ensuring they maximize their wealth while staying protected from costly mistakes. Our experienced team provides breakthrough insights and strategic tax planning to guide your financial success every step of the way.

Expertise You Can Trust

With years of experience in tax planning and financial strategy, Shelford Wealth Strategies has become a trusted partner for small business owners, influencers, and content creators across the country.

Comprehensive, Compliant Solutions

Our services go beyond just advice—we provide actionable, solutions that protect your business from costly mistakes. From Reasonable Compensation Reports to strategic tax insights, we cover all the bases to ensure you’re making the most of every dollar.

Dedicated Support

We’re here for you every step of the way. Our team of experts is always available to provide guidance, answer your questions, and keep you updated on the latest tax laws and financial strategies.

WEALTH INSIGHTS BLOG

The Latest News & Updates To Save Money & Avoid Audits

Frequently Asked Questions

Frequently Asked Questions About Our Reasonable Compensation Reports

A Reasonable Compensation Report determines the fair market salary an S-corporation owner should pay themselves. This report is essential to avoid IRS scrutiny and potential penalties. By ensuring you’re paying yourself a reasonable salary, you stay compliant with IRS regulations and minimize your risk of being audited.

The IRS considers several factors when determining reasonable compensation, including your role in the company, industry standards, and the amount of time you dedicate to the business. Our reports analyze these factors to provide an accurate and defensible salary recommendation.

Failing to pay yourself a reasonable salary can trigger an IRS audit. If the IRS determines that your salary is unreasonably low, they can reclassify distributions as wages, leading to back taxes, penalties, and interest. Our reports help you avoid these risks by ensuring compliance.

It’s incredibly easy! Simply provide us with some basic information about your business and role, and we’ll take care of the rest. Our team of experts will analyze the data and deliver a comprehensive report that’s both accurate and easy to understand.

Our reports are highly affordable at just $350 per report. This one-time investment can save you thousands in potential IRS penalties and back taxes. Plus, it’s a small price to pay for peace of mind.

Yes! We offer a yearly subscription option that reduces the cost to just $275 annually. This subscription ensures you receive an updated compensation report each year, keeping you compliant with the latest IRS guidelines.

Once we have all the necessary information, we typically deliver your Reasonable Compensation Report within 3-5 business days. If you need it sooner, expedited options are available.

Our reports are based on comprehensive research and industry standards, making them highly accurate and reliable. We use a combination of IRS guidelines, industry data, and proprietary analysis to ensure your compensation is both reasonable and defensible.

Absolutely. Our Reasonable Compensation Reports are designed to withstand IRS scrutiny. In the event of an IRS audit, your report will serve as strong evidence that your salary is reasonable and compliant with tax laws.

Getting started is simple! Just contact us through our website or give us a call. We’ll guide you through the process, gather the necessary information, and have your report ready in no time.